What does it mean to be mission critical?

And is selling something essential an indicator of a great investment?

When there's a war going on, don't buy the companies that are doing the fighting; buy the companies that sell the bullets. - Peter Lynch

If we take the literal definition of mission critical, it means to be vital to normal function.

At face value, it sounds like if you want an easier time then being mission critical is a recipe for success. Who doesn't want to provide something customers can't live without?

But does this actually translate into better investments? Grab a cup of tea, as we're about to unravel the layers behind mission criticality.

To begin deciphering mission criticality, let’s talk life and death

Let's start with something you literally can't live without: If you haven't shared this blog yet with all your friends and acquaintances, you should do that right now. Help support the blog if you enjoy and want to keep reading these ramblings :)

Half joking aside - food and water. You will actually stop existing without these, so it can't really get more mission critical than that.

Conclusion: Selling food and water must be a slam dunk. How is fast food doing?

Well, compared to the S&P500 index fund (ticker: VOO) there’s a lot more losing than you might hope for by selling food. I expected more from you, Tim Hortons (parent company ticker: QSR). /s

How about beverage companies?

That’s quite a bloodbath vs. the S&P500, with only Monster Beverage (ticker: MNST) doing slightly better. Note that Celsius Holdings (ticker: CELH) is an omitted outlier here, but otherwise it seems generally bleak for beverage companies.

Why can’t selling something that is literally life and death consistently make lots of money?

The missing piece here is that it’s not sufficient to be selling something essential, whether literally or figuratively. The actual question you need to ask is can the customer live without you specifically. For the above companies, if one suddenly stops existing then the customer will just find another business that sells the same thing - they’re a dime a dozen.

So mission critical is where the customer can’t live without the specific business in question. Is there more to this though?

How does a business become truly mission critical?

Simple:

It saves scarce resources like time and money compared to other options

You’re the only option

There’s too much inertia to switch to something else

But does this lead to better investment returns?

Saving resources

Walmart (ticker: WMT), Costco (ticker: COST), and BJ’s Wholesale Club (ticker: BJ) all try to make money by helping customers save money. All three beat the market, although to varying extents.

It helps to save customers their resources, but business context and execution matter too when it comes to how much you beat the market.

You’re the only game in town

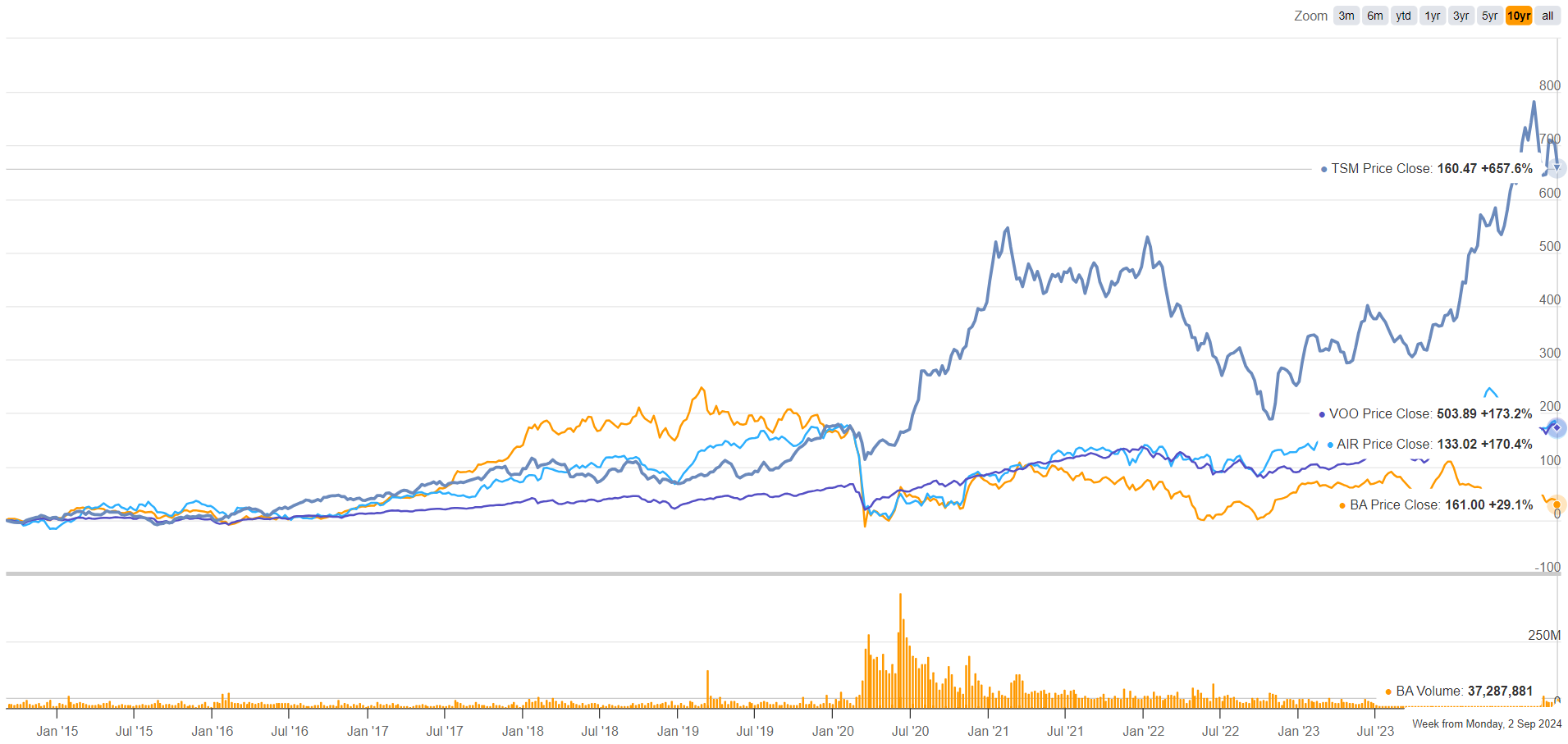

Boeing (ticker: BA) and Airbus (ticker: AIR) are the leading commercial aircraft suppliers by far for airliners around the world.

You might remember Boeing from all the airplane safety scandals, like software called the Maneuvering Characteristics Augmentation System (MCAS) plunging planes into the earth because of a reliance on only one angle-of-attack sensor and not telling any of the pilots about the software change to avoid costly pilot simulator re-training. The software was added to fix a plane weight redistribution problem caused by using larger engines for better fuel efficiency and pushing the engines more forward on the aircraft to make them fit. Yeah, that Boeing.

Functionally it might as well be a duopoly, and can’t really get more mission critical then when airliners need your product to… do their basic function of flying people from one destination to another.

Meanwhile, Taiwan Semiconductor Manufacturing Company (TSMC; ticker: TSM) makes all the advanced computer chips for anything that gets raved about (sorry, trailing edge chips and Intel/Samsung). Also can’t get much more mission critical than that.

One. of. these. three, are. not. like, the others…

So basically, you can be the only game in town and still screw it up vs. the S&P500 depending on business context. Requiring more thought 1, mission criticality 0.

Inertia

Nvidia designs graphics processing units (GPUs) and is the world leader in selling generative AI FOMO:1

Let me give you an example of time being really valuable, why this idea of standing up a data center instantaneously is so valuable and getting this thing called time-to-train is so valuable. The reason for that is because the next company who reaches the next major plateau gets to announce a groundbreaking AI. And the second one after that gets to announce something that's 0.3% better. And so the question is, do you want to be repeatedly the company delivering groundbreaking AI or the company delivering 0.3% better?

And that's the reason why this race, as in all technology races, the race is so important. And you're seeing this race across multiple companies because this is so vital to have technology leadership… The difference between time-to-train that is 3 months earlier just to get it done, in order to get time-to-train on 3 months' project, getting started 3 months earlier is everything.

- Jensen Huang, Founder, President and CEO of Nvidia

And while both customers and competitors alike see the exploding data center market and want to find competitive alternatives (whether it be customers designing their own application-specific integrated circuits, or ASICs, or other folks like AMD trying to design competitors to Nvidia’s H100), they’ve all failed to make a significant dent so far.

Reason being inertia - it’s hard to compete with Nvidia’s Compute Unified Device Architecture (CUDA), which makes it much easier to use popular programming languages for GPU-accelerated applications.

Conclusion: Mission criticality is great to have, but there’s more than meets the eye when it comes to outsized investment returns.

What’s the common thread differentiating the mission critical™ winners from losers?

Strength of the value proposition to compel more profit.

Here’s why: If we’re going to explode share price from a rational perspective, growing earnings per share is critical unless we’re playing in the realm of meme stocks with wild valuation changes.

Share repurchase policy differences aside, the driver of earnings growth over time is the ability to

Open up more of the existing customer’s wallet,

Bring in more customers, whether already part of your core customer base or some new customer segment, or

Bring in the same amount of money with a more efficient cost structure

Through this lens, we can see more clearly what differentiates the above examples:

Saving resources

Costco does a better job than BJ’s of selling cheap and high quality products to its customers given factors like economies of scale

Walmart might still save its customers money, but having such a huge consumer base makes additional earnings growth at that scale quite challenging

For WMT a 10% revenue increase is +$65B and a 10% earnings increase is +$1.5B, and if you think about their average customer that’s a huge incremental ask for a customer base without a ton of purchasing power per capita

In a poetic way, size helps one business (COST) and hurts another (WMT)

Only game in town

Airliners don’t feel like Boeing and Airbus are harbingers of value that deserve having more money shoveled down their throats, and rather see them as a line item that needs to be properly managed to stay afloat of all the other ballooning costs (e.g., labour and fuel, amongst other things)

TSMC reliably manufactures the semiconductor chips that are fueling a value-creating technology revolution across multiple sectors and is by far the foundry market leader compared to Intel and Samsung (for various reasons, including scorn against Texas Instruments)2

Scale helps TSMC take on the cash-consuming investments to build new fabrication facilities at a loss for years on end, whereas a competitor like Intel can’t endure the capital expenditures (capex) required, amongst other problems

Nvidia

FOMO is a great motivator for earnings growth

Half-joking aside, the perceived benefits of being the leader in generative AI has triggered a capex race to the bottom, with the rate-limiting step not even being GPU quantities but rather energy requirements

The real question will be at what point do AI startups start making enough profit to support the ecosystem

Key takeaway: To be truly mission critical and translate into a better investment, you need to sell something customers can’t live without and want to spend more money on over time.

That’s it for today. If you felt that this article was intellectually stimulating, please smash that subscribe button and share it with everyone you know. Also consider sending over monthly tea as a paid subscriber :)

Disclaimer: All posts on “Tea Time to Ponder” are for informational purposes only. This is NOT a recommendation to buy or sell any of the securities discussed. Please do your own homework before investing your money.

FOMO = fear of missing out

Okay maybe not literally, but TSMC founder Morris Chang was turned down from a CEO gig at Texas Instruments and then started TSMC as a 55-year old. Depending on how you want to view it, TSMC crushing other foundries is a business model innovation driven by 1) focusing on being a fab only and not a chip designer, and 2) as Chang puts it, being a partner with customers as opposed to having a more transactional relationship.

If you feel like reading a bit more: https://www.wsj.com/tech/tsmc-morris-chang-taiwan-semiconductor-chips-entrepreneurship-506fcbc4